Poverty in this world of ours is a great curse is admitted on all hands. Poverty is not only distressing but it is also demoralizing.

A poor man is a disgrace to society. But the worst thing about poverty is that a poor man is caught in a vicious circle.

Being poor, he lacks the means to prosper, and, since he lacks the mean to prosper, he must remain poor. The vicious circle is complete.

Poverty leads to inefficiency and incapacity to do well, and inefficiency and incapacity must end in poverty. That is why we generally find that poverty is perpetuated from generation to generation, it is cumulative. That is the curse of poverty and its vicious circle.

ADVERTISEMENTS:

What is true of the individual is true of the community as a whole. For an under-developed economy to develop economically is indeed an uphill task. The rate of savings and investment in an under-developed economy is too low to make for rapid development, and since the rate of savings and development is too small, it must remain under-developed.

Here is the vicious circle of poverty embracing the entire economy. “It implies a circular constellation of forces tending to act and react upon one another in such a way as to keep a poor country in a state of poverty. A country is poor because a country is poor.”— (Nurkse).

ADVERTISEMENTS:

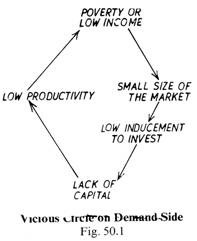

The crux of the problem is capital formation. The rate of capital formation is affected by both demand for and supply of capital. Let us take the demand side first. In a poor country, the level of productivity and so of incomes is very low, which means a low purchasing power. Since the purchasing power of the people is low, the scope for business and industry is correspondingly limited. The inducement to invest is practically absent. The rate of investment being low, productivity is low which means that the incomes are small, completing the vicious circle.

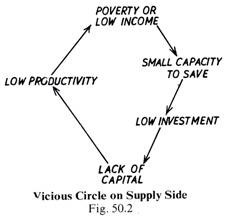

On the side of supply, in a poor country having a low level of income, the rate of savings must be small. The resulting lack of capital leads to low productivity and low incomes thus completing the vicious circle. The two vicious circles relating to the demand side and the supply side can be represented diagrammatically thus (Figs. 50.1 and 50.2):

The vicious circle must be broken at both ends. The supply of savings, from both domestic and foreign sources, must be increased and the State must provide incentives for investment by means of a suitable monetary and fiscal policy. The low level of real income reflecting low productivity is the crucial point both in the demand circle and in the supply circle. Of these the supply end is more difficult to break than the demand end. It is obviously easy to create or increase demand for capital, but it is not so easy to make up the deficiency of capital.

The country may also suffer from lack of natural resources like water and mineral resources or the poverty of the soil. But in the matter of economic development, the crucial drawbacks are the small capacity to save and the small inducement to invest. Other deficiencies can be made up and the handicap of the natural factor removed if the problem of capital formation is successfully tackled.